VA Cash-Out Refinance: What It Is and How to Use It

If you have a VA loan and want to take some of the equity out of your home, consider a VA cash-out refinance. By refinancing your VA loan, you can access the equity in your home to pay off debt, complete a home improvement project, or for any other use.

Before proceeding with a cash-out refinance on your VA loan, it’s important to understand exactly how things work, some of the eligibility requirements, and the pros and cons.

Key Takeaways

- If you have a VA loan, you can use a VA cash-out refinance to access a portion (sometimes all) of your home’s equity.

- If you have a conventional mortgage, a VA cash-out refinance allows you to move into a VA loan.

- To qualify for a VA refinance, you must meet the minimum requirements set by both the VA and the lender.

What Is a VA Cash-Out Refinance?

A VA cash-out refinance loan allows homeowners to replace their current VA loan with a new loan at a higher amount. The difference between the two loan amounts is paid to the homeowner in a lump sum payment.

If you meet the requirements for a VA loan but currently have a conventional mortgage, you can use a VA cash-out refinance to access your equity and move into a VA loan to take advantage of its benefits.

“A VA cash-out refinance allows you to tap into your home’s equity and pull out cash with the convenience of a refinance attached, provided that you’ve earned enough equity in your property and different requirements are met,” explains Jason Gelios, a Realtor in southeast Michigan who specializes in loans for Veterans. “These types of loans are backed by the Department of Veterans Affairs, making them less risky to lenders.”

How the Loan Works

When refinancing a VA loan, you take out a brand-new loan with a higher principal balance than your current loan. The difference is given to you as a lump sum cash payment.

When you refinance, your loan term resets. You can choose a 30-year term, which would most likely lower your monthly payment, or refinance into a 15—or 20-year term, which would help you pay off your loan faster.

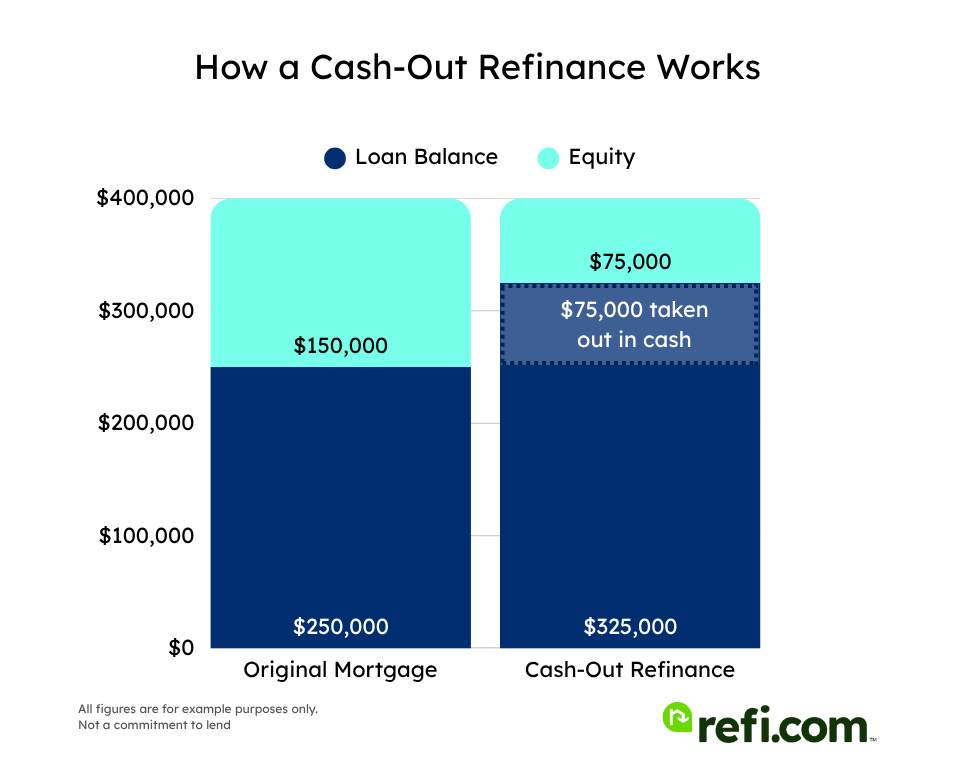

Let’s walk through what the numbers would look like if you refinanced your VA loan.

Let’s assume your home is currently valued at $400,000, and you still owe $250,000 on your mortgage. You’ve been preapproved with a VA mortgage lender for up to $350,000. You decide to do a VA cash-out refinance for $325,000, which will pay off the $250,000 balance on your current loan and give you a $75,000 cash payment minus closing costs.

Lots of numbers there, so let’s break it down.

- Home value: $400,000

- Current mortgage balance: $250,000

- Current equity: $150,000 ($400,000 – $250,000)

You choose to take out your new loan for $325,000, which gives you $75,000 in cash.

- Loan amount: $325,000

- Loan amount to pay off current mortgage: $250,000

- Cash-out portion: $75,000 (minus closing costs)

- Remaining equity: $75,000 ($400,000 – $325,000)

Let’s take a look at how that looks:

How to Use a VA Cash-Out Refinance

This loan type is a great way to pull some equity out of your home to pay down debt, complete a home improvement project, or many other possibilities. However, accessing your equity isn’t the only reason you might do a cash-out refinance on a VA loan.

Eliminating Mortgage Insurance

One of the perks of a VA loan is that mortgage insurance isn’t required. That means if you currently have an FHA or conventional loan and are paying for mortgage insurance each month, you could refinance to a VA loan and eliminate your mortgage insurance payment. A VA cash-out refinance is the only option for refinancing from a non-VA loan to a VA loan.

Plus, just because you’re using a VA cash-out refinance doesn’t mean you have to pull equity out of your home. You could use this loan type to eliminate your insurance payment and potentially lower your interest rate, potentially saving a significant amount each month.

Refinance Away From an Expensive Mortgage

Depending on your situation when you first bought your home, you might have a mortgage with unfavorable terms. This could include any of the following:

- Adjustable rate mortgage

- Interest-only mortgage

- Piggyback loans

- Alt-A loans

- Constructions loans

Refinancing can also be beneficial if your financials and current credit score have improved since it would help you receive a more favorable interest rate.

Refinance a High Loan-to-Value (LTV) Loan

During the housing crisis in the late 2000s, many homes lost a significant amount of value, causing many homeowners to end up underwater on their mortgages. When this happens, it’s nearly impossible to refinance a conventional loan to take advantage of lower rates.

That is not the case with VA loans. Because VA loans are available to borrowers with a 100% LTV, you can refinance into a VA loan even if you don’t have any equity in your home.

Pros and Cons

VA cash-out refinancing offers many benefits to military homeowners, but you should also understand the downsides of this type of mortgage refinancing.

Pros

- Flexible use of cash: You can use your cash back from a VA cash-out refinance in any way you like.

- Convert a non-VA loan to a VA loan: Even if you don’t currently have a VA loan, you can still convert your current loan into a VA loan through their cash-out refinance program. You just need to be eligible through the VA.

- Lower rates: VA loans typically have lower interest rates since the federal government backs them. Let’s take a look at how interest rates are trending right now:

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 30-year Fixed Refinance 6.35% 6.37% 30-year Fixed Fha Refinance 5.56% 6.77% 30-year Fixed Va Refinance 5.68% 5.82%

Cons

- Increased debt: When you pull equity out of your home through a cash-out refinance VA loan, you increase your debt. This can be risky if housing prices decline.

- VA funding fee: When you refinance your loan through the VA, you’re required to pay a VA funding fee.

- Eligibility requirements: Only active military, Veterans, and some surviving spouses are eligible for the VA loan program.

VA Cash-Out Refinance Eligibility and Requirements

To qualify for a VA cash-out refinance, you must meet some eligibility requirements through the VA. Plus, you also need to qualify with the lender.

Who Is Eligible for a VA Loan?

To be eligible for a VA loan, you must fit into one of the following categories:

- Active-duty service member

- Honorably discharged with minimum service requirements met

- Surviving spouse

Requirements to Be Approved for a VA Cash-Out Refinance

You must meet the lender’s minimum requirements when applying for a VA loan. The table below breaks these down and compares typical requirements across VA, FHA, and conventional lenders.

| VA Cash-Out | FHA Cash-Out | Conventional Cash-Out | |

| Credit Score | 580 – 620 | 580 | 620 |

| LTV | 100% | 80% | 80% |

| DTI | 41% – 50% | 56.9% | 50% |

| Loan Limits | N/A | $524,225 | $806,500 |

How to Get a Cash-Out Refinance

If you’re ready to start a VA cash-out refinance, follow these steps:

- Choose a VA lender: You first want to choose a VA lender for your refinance. Ideally, start with at least three, compare their rates and fees, and choose the best lender for your situation.

- Get your Certificate of Eligibility (COE): This verifies that you meet the VA eligibility requirements.

- Apply and submit financial documents: Now that you know which lender you’ll use and you have your COE, you need to provide the lender with all your financial documents. These include pay stubs, tax forms, and bank and credit card statements.

- Get a home appraisal: Part of the process includes having your home appraised. This verifies its value, so you know how much equity you can access.

- Wait for underwriting to finish: During the underwriting process, the lender goes through your credit history and financial documents to decide whether you’re eligible to borrow the requested amount. If they have questions, you’ll want to respond quickly to ensure the process moves forward at a decent pace.

- Close the loan: Finally, when closing day arrives, you sign all the loan documents and pay the closing costs and your VA funding fee.

VA Cash-Out Refinance Costs

A VA cash-out refinance can be a great way to access the equity in your home or receive more favorable terms on your loan. However, you must understand that refinancing isn’t free. You need to pay closing costs on your loan as well as a VA funding fee.

The funding fee is based on whether this is the first time using a VA loan.

- If this is your first VA loan, the funding fee is 2.15% of the loan amount.

- If you’ve used a VA loan in the past, the funding fee is 3.30% of the loan amount.

The VA allows you to either pay this funding fee at closing or include it in your loan amount. Just keep in mind that if you add the fee to your loan, you pay interest on that amount.

Other Cash-Out and Home Equity Options

If you decide that a VA cash-out refinance isn’t the best option, there are some alternatives you can consider instead.

- Conventional cash-out refinance: Conventional cash-out refinances have a slightly higher interest rate and stricter requirements but are available to anyone who doesn’t qualify for a VA loan. Plus, you are responsible for mortgage insurance if your LTV exceeds 80%.

- VA Streamline Refinance: If you already have a VA loan, you can use a VA Streamline refinance to take advantage of lower interest rates. However, you won’t be able to access any of the equity in your home.

- Home equity loan: These loans are considered second mortgages. You can access the equity in your home as a lump sum cash payment, but in exchange, you make monthly payments based on a fixed interest rate.

- Home equity line of credit (HELOC): Similar to a home equity loan, these are second mortgages; however, they’re revolving lines of credit. They allow you to access equity at different times during a draw period. HELOCs usually have a variable interest rate, though.

VA Cash-Out Refinance: Is It Right for You?

A VA cash-out refinance can be a smart way to tap into your home’s equity. However, it’s important to ensure you understand the costs and benefits. Once you’re ready to move forward, make sure you check the current VA refinance rates.