What Is a Home Equity Loan? A 2025 Guide for Homeowners

A home equity loan lets you turn your home’s value into cash without impacting your current mortgage. It’s often called a “second mortgage” because it’s an additional loan that stacks on top of your original mortgage, keeping your first mortgage terms in place.

This guide explains how home equity loans work, who they’re best for, how they compare to similar options like HELOCs and cash-out refinances, and how to use them wisely.

- Home equity loans are second mortgages that provide a lump sum with fixed payments and interest, making them ideal for one-time expenses like renovations, college tuition, or debt consolidation.

- They typically offer lower rates than unsecured loans, but you’re borrowing against your home. So, missed payments could put your property at risk.

- Compared to HELOCs and cash-out refinances, home equity loans are best for borrowers who want upfront cash, rate stability, and don’t need to refinance their existing mortgage.

What Is a Home Equity Loan?

A home equity loan is a type of secured loan that allows you to borrow a lump sum of money using your home’s equity as collateral.

- You receive the loan as a one-time lump sum.

- You repay it over time in fixed monthly payments.

- It typically comes with a fixed interest rate and repayment term (e.g., 10, 15, or 20 years).

Because the loan is backed by your property, rates are usually lower than those on unsecured debt like credit cards or personal loans.

How Does a Home Equity Loan Work?

Here’s how the process typically works:

Determine your home equity

Equity is the difference between your home’s current market value and what you still owe on your mortgage.Borrow a percentage of that equity

Most lenders allow you to borrow up to 75%–85% of your home’s value, minus what you owe.Receive funds upfront

The full loan amount is disbursed at closing.Repay in monthly installments

You’ll pay principal + interest until the loan is paid off.

Example:

| Home Value | $400,000 |

| Tappable Value (ex. 85%) | $340,000 |

| Existing Loan | -$250,000 |

| Potential Home Equity Loan | =$90,000 |

Pros and Cons of Home Equity Loans

Pros

- Fixed rate and predictable payments

- Lower interest rates than unsecured loans

- Lump sum access to large amounts

- Interest may be tax-deductible if used for home improvements (consult a tax advisor)

- Doesn’t impact your current mortgage (great for those with low rates)

Cons

- You’re putting your home at risk if you fall behind on payments

- You’ll pay interest on the full loan amount—even if you don’t use it all

- Closing costs apply, just like with other types of mortgages

- Reduces your available home equity, which could matter if property values drop

Who Should Consider a Home Equity Loan?

Home equity loans are a strong option for homeowners who:

- Need a large amount of money upfront

- Prefer the stability of fixed payments and interest rates

- Have significant equity and strong credit

- Plan to use the funds for home improvements, debt consolidation, or major expenses like college tuition

- Are happy with their current mortgage terms

They’re less ideal if you:

- Need ongoing access to funds (in which case, consider a HELOC)

- Plan to move or sell soon

- Are unsure about your repayment ability

- Stand to gain from a mortgage refinance (e.g. you can lower your mortgage rate)

Home Equity Loan vs. HELOC vs. Cash-Out Refinance

| Feature | Home Equity Loan | HELOC | Cash-Out Refinance |

| Payout | Lump sum | As-needed line of credit | Lump sum |

| Rate type | Fixed | Usually variable | Usually fixed |

| Monthly payment | Fixed | Varies (interest-only at first) | Fixed |

| Refinance your first mortgage? | No | No | Yes (replaces your current loan) |

| Best for | One-time large expenses | Ongoing or flexible spending | Tapping equity + lowering rate or changing term |

Here’s how the differences break down in more practical terms:

Home Equity Loan vs. HELOC

A home equity loan offers the predictability of fixed monthly payments. You know exactly what you’ll pay each month, which makes it easier to budget. This is ideal if you’re borrowing for a one-time expense with a clear price tag—like a renovation or tuition payment.

A HELOC, on the other hand, works more like a credit card. You borrow as needed and pay interest only on the balance you use. That flexibility can be helpful if your costs are spread out over time, but it comes with more payment variability and the risk of rate increases if interest rates rise.

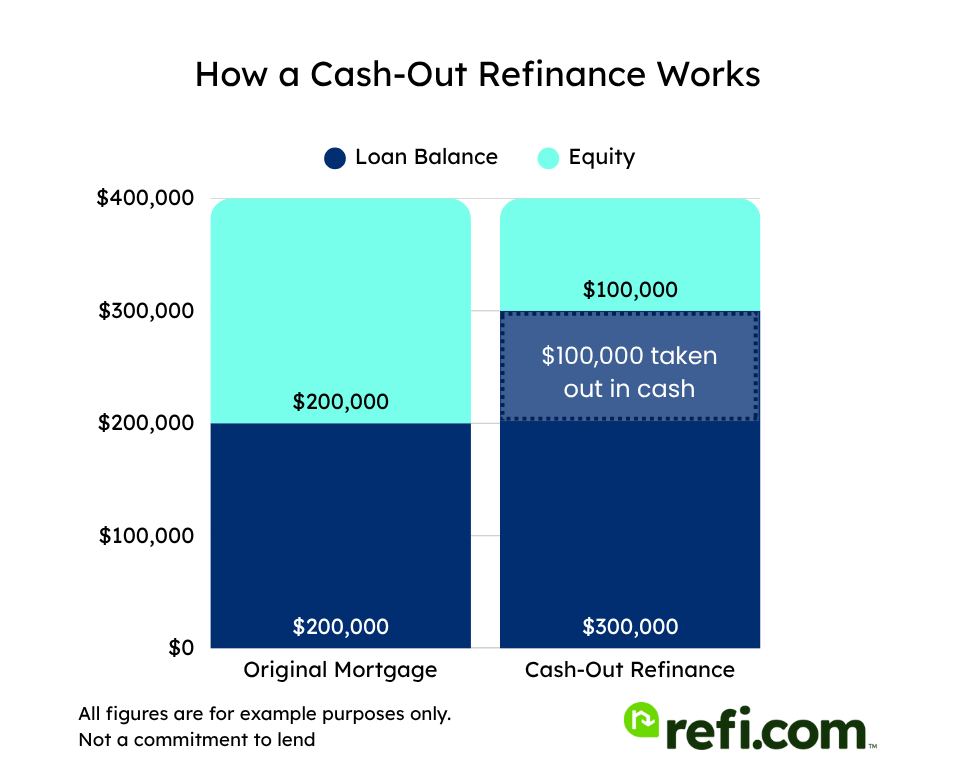

Home Equity Loan vs. Cash-Out Refinance

With a home equity loan, your first mortgage stays intact. You keep your current interest rate—something that’s especially valuable if you locked in a low rate in 2020 or 2021. The home equity loan becomes a second mortgage, with its own terms and payment.

A cash-out refinance replaces your existing mortgage entirely with a new, larger loan. That means you’ll lose your current mortgage rate and start over with a new term and new rate. It may make sense if you want to consolidate everything into one loan, but less so if your current mortgage is too good to give up.

How we source rates and rate trends

Rates based on market averages as of Dec 02, 2025.Product Rate APR 15-year Fixed Refinance 5.37% 5.42% 30-year Fixed Refinance 6.35% 6.37%

How to Get a Home Equity Loan

If you’re considering a home equity loan, here’s how to get started:

- Check your equity: Use your home’s current market value and subtract your remaining mortgage balance to estimate your available equity.

- Review your credit and finances: Strong credit and a manageable debt-to-income (DTI) ratio can help you qualify and secure better rates.

- Shop around: Compare offers from banks, credit unions, online lenders, and mortgage companies. Look at:

- Interest rates (fixed vs. variable)

- Repayment terms (e.g., 10, 15, or 20 years)

- Fees and closing costs

- Loan-to-value (LTV) limits

- Get prequalified: This can give you an idea of how much you can borrow and at what rate—without affecting your credit.

- Understand the full cost: Ask for a loan estimate and understand the monthly payment, total interest cost, and whether the loan fits your long-term budget.

Once you’ve selected a lender, you’ll go through an application and underwriting process similar to your original mortgage.

Example Scenarios

Home Renovation

You want to renovate your kitchen and two bathrooms and expect the work to cost $80,000. A home equity loan gives you that lump sum upfront so you can pay contractors in full. You know the cost, so a fixed monthly payment makes budgeting easy.

Paying for College

Your child is starting college and you need $50,000 to cover tuition over the next year. A home equity loan can provide that amount, potentially at a lower interest rate than federal PLUS loans or private student loans.

Debt Consolidation

You have $60,000 in high-interest credit card debt. A home equity loan allows you to consolidate that into a single fixed monthly payment with a much lower interest rate, helping you pay it off faster.

Final Thoughts

A home equity loan can be a smart way to access low-cost financing—especially if you know exactly how much you need and prefer stable monthly payments.

But like any loan secured by your home, it comes with risk. Make sure your budget can handle the new payment, and that you’re using the funds to create long-term value, not short-term gratification.

Ready to get started? Start your application with Refi.com today.