How to Get Equity Out of Your Home Without Refinancing

Equity is one of the biggest perks of homeownership. As you pay down your mortgage or your home increases in value, you build equity — and with it, long-term financial strength. Equity boosts your net worth, creates opportunities for future moves, and can even help build generational wealth.

But equity can also be a financial resource in the here and now. You can use it to renovate your home, cover education costs, or even tap it in an emergency for things like medical bills or car repairs.

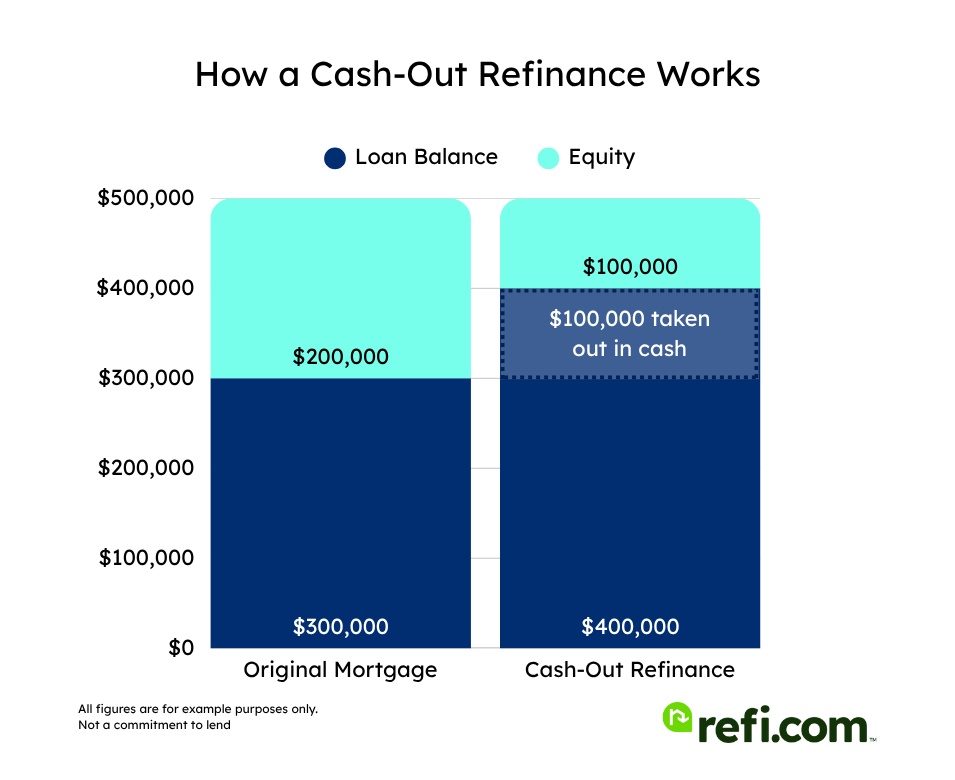

So how do you go about accessing that equity? A cash-out refinance is one common option — but it’s not always the best fit, especially when interest rates are high or you’re hesitant to restart your loan term and pay new closing costs.

Fortunately, refinancing isn’t your only choice. Here’s what to know about how to get equity out of your home without replacing your current mortgage.

The least you need to know:

- You don’t have to refinance to access your home equity. Options like HELOCs, home equity loans, home equity investments, and reverse mortgages let you tap equity while keeping your current mortgage intact.

- HELOCs and home equity loans are second mortgages — ideal if you can manage another monthly payment and want flexible or predictable terms.

- Reverse mortgages are available to homeowners 62 and older, offering cash without monthly payments — but the loan comes due when you move out or pass away.

- Home equity investments provide a lump sum with no monthly payments or interest but require sharing future home value gains when you sell.

Can you take equity out of your home without refinancing?

Yes, you can take equity out of your home without refinancing, and there are several ways to do so.

One way to access your equity without refinancing is by taking out a second mortgage. This is a separate loan that’s secured by your home and exists alongside your primary mortgage. Two of the most common types of second mortgages are home equity loans and home equity lines of credit (HELOCs), both of which let you borrow against the equity you’ve built — without replacing your current loan.

You can also use a home equity investment instead of refinancing. These are fairly new tools that let you tap your equity without taking on monthly payments or interest.

Finally, if you’re age 62 or older, you may be eligible for a reverse mortgage. This option lets you convert equity into cash without monthly payments — though the loan is repaid when you move out, sell the home, or pass away.

Here’s a quick snapshot of common options and how they compare. Keep in mind that these options often vary by lender:

| Feature | Cash-Out Refinance | HELOC (Home Equity Line of Credit) | Home Equity Loan | Home Equity Investment (HEI) | Reverse Mortgage |

| Payment Structure | New mortgage payment | Interest-only during draw period, then amortized | Fixed monthly payments | No monthly payments | No payments while living in home |

| Interest Rates | Fixed or variable | Variable (often) | Fixed (usually) | N/A | Fixed or variable |

| Interest Rate Comparison | Can be the lowest, especially in low rate environment | Typically higher than mortgage rates | Higher than first mortgage, but lower than unsecured loans | No interest rate | Usually higher than conventional mortgage rates |

| Loan Term | 15–30 years, usually | 10-year draw + 10–20-year repayment | 5–30 years | Typically 10–30 years or upon sale | Due upon sale, move-out, or death |

| Funds Received | Lump sum at closing | Withdraw as needed | Lump sum | Lump sum | Lump sum, monthly, or line of credit |

| Upfront Costs | 2–5% of loan amount | Often lower, may include annual fees | Moderate closing costs (1–5%) | May include service or origination fees | High – usually 2–5% of home value |

| Risk of Foreclosure | Yes | Yes | Yes | No | Yes |

| Best For | Lowering rate + getting cash | Ongoing access to cash | One-time major expenses | No payment flexibility + large equity | Seniors needing cash without selling |

Home Equity Line of Credit (HELOC)

A home equity line of credit, or HELOC, is a kind of second mortgage, meaning it’s an additional loan on top of your main mortgage (whereas refinancing replaces your main mortgage).

With a HELOC, part of your home equity is turned into a line of credit, which you can withdraw from as needed over a period of 10 years. It works much like a credit card, allowing you to use (or not use) as much of the credit line as you’d like.

The perk of this is that you only pay interest on what you borrow, and you have a long time to withdraw funds. This is nice if you need money over an extended period or if you’re not sure how much something will cost, such as with an ongoing renovation project or medical treatment.

The downside is that these usually have variable rates, so your rate and payment could change quickly. It also adds a second monthly mortgage payment to your household.

If you’re comparing a refinance with a HELOC, a refi might be better if it gives you a lower rate or payment than you currently have. A HELOC is likely better if you already have a low rate on your main mortgage loan.

In today’s rate environment, refinancing likely means trading in that low rate for a much higher one. A HELOC can also be smart if you need funds for a prolonged period or aren’t sure of the total costs of something.

Related: HELOC Calculator: How Much Can I Get?

Home Equity Loan

A home equity loan is another type of second mortgage you take out in addition to your main mortgage. Unlike a HELOC, though, you don’t get a line of credit to pull from over time. Instead, home equity loans give you a single lump-sum payment after closing. You’re then free to use the funds however you wish.

Home equity loans usually come with fixed rates, so you don’t need to worry about changing payments, and you can pick terms of up to 30 years. The drawback is that you have to deal with a second monthly payment, and as with any mortgage, it puts your home at risk of foreclosure. If you’re unable to make your payments, the lender can seize your home.

A home equity loan is usually a better option than a refinance if you don’t want to replace your current terms, rate, and payment on your existing mortgage. They can also be smart if you need a reliable monthly payment and you know how much you need to borrow.

Refinancing may be a better choice if you’re worried about managing two payments or if you could qualify for a lower rate and payment than you have on your current loan.

Related: Home Equity Loan Calculator: How Much Can I Get?

Home Equity Investment (HEI)

A home equity investment is your third option for taking out home equity without refinancing. With this tool, you sell a stake in your home’s equity, in turn receiving a lump sum payment. You won’t make payments or pay interest for the money, but when you sell the home, the investor takes a cut of the profits.

Home equity investments are completely separate from your mortgage. They don’t require refinancing, they don’t add another payment, and they’re not even an additional loan.

The big upside of this arrangement is that you’re not adding any new financial stress to your household or paying interest. You can also get potentially large amounts, as some home equity investment companies offer up to $600,000. This will depend on various factors, though – including equity, property value, and your financial profile.

On the downside, you could end up paying a hefty amount — much more than you borrowed — if your home grows a lot in value.

If you’re weighing a refinance vs. a home equity investment, look at the terms of your mortgage and compare them to current market conditions. If refinancing would give you a better rate or payment, it may be the best move. But if you need a large amount of funds, can’t handle a second monthly payment, and don’t plan to sell for a while, a home equity investment may be the better option.

Reverse Mortgage

A reverse mortgage is another way to tap into your home equity without refinancing — but it’s only available to homeowners age 62 and older. With a reverse mortgage, you borrow against the equity in your home and receive the money as a lump sum, monthly payments, or a line of credit. You don’t have to repay the loan as long as you live in the home, but the balance comes due when you move, sell the property, or pass away.

When the homeowner passes away, the heirs typically repay the loan by selling the home. If the home sells for more than the loan balance, the heirs keep the difference. If it sells for less, they’re not on the hook for the shortfall — reverse mortgages are non-recourse loans, which means the lender can’t pursue other assets to recover the difference.

Reverse mortgages can be a helpful option for retirees who need extra income but want to stay in their homes. Just keep in mind that fees can be high, and the loan balance will grow over time, potentially leaving less equity for your heirs.

When Refinancing Is the Better Option

Despite a variety of great options, refinancing can still be the best option for tapping your home equity. In some situations, replacing your loan could put you in a better long-term financial position.

A cash-out refinance to tap home equity may be the better option if:

- You can lower your interest rate. If market rates have dropped since you got your mortgage — or your credit score has improved — refinancing could mean a lower rate and big savings over time.

- You want to change your loan term. Refinancing gives you a chance to shorten your loan term to pay off your home faster or extend it to reduce your monthly payment.

- You need to add or remove a borrower. Life happens — divorce, marriage, or changing financial responsibilities can all require a change to who’s on the mortgage. In most cases, refinancing is the only way to officially add or remove someone from the loan.

- You’re looking to consolidate debt. A cash-out refinance allows you to roll high-interest debt into a lower-rate mortgage — often saving you money and simplifying your payments.

- You’d rather avoid managing two loans. Compared to taking on a second mortgage (like a HELOC or home equity loan), a cash-out refinance combines everything into one monthly payment.

Even in today’s higher-rate environment, refinancing can still make sense depending on your goals. If you’re unsure whether it’s the right move, run the numbers or talk to a mortgage professional. The right decision depends on your current loan terms, equity position, and long-term financial plans.

Related: When to Refinance Your Mortgage

Things to Consider Before You Tap Your Home Equity

Before you commit to any home equity product, ask yourself these bigger-picture questions.

1. How much equity do you actually have?

You may have more (or less) equity than you think. Most lenders require you to leave 15% to 20% equity in the home after borrowing, so know what’s accessible to you before you get too far along.

2. What will you use the funds for?

Equity can be a smart tool for home improvements or debt consolidation — things that can either raise your home’s value or reduce your interest burden. Using equity for short-term wants or nonessential expenses could put your finances at risk.

3. Can you handle an extra monthly payment?

HELOCs and home equity loans create a second monthly obligation. Make sure your budget has the flexibility to absorb it, especially if you’re considering a product with a variable rate.

4. How long will you stay in the home?

If you plan to move in the next few years, refinancing may not be worth the closing costs, and home equity investments or reverse mortgages may not have time to deliver their full benefits.

5. What are the tax implications?

Interest on a HELOC or home equity loan may be tax-deductible — but only if the funds are used to “buy, build, or substantially improve” the home. If you plan to use the funds for something else, consult a tax advisor to understand your options.

6. Are you comfortable with the risk?

Tapping equity means putting your home on the line. Missed payments on second mortgages can lead to foreclosure, and with home equity investments, your future proceeds may be significantly reduced.

If you’ve worked through these questions and feel confident, you’re ready to move forward. Next up: choose the best product for your needs and apply with a lender.

How to Tap Home Equity Without Refinancing

If you’re ready to move forward, here’s how to proceed with tapping your equity:

1. Calculate Your Equity

Start by figuring out how much equity you actually have. Subtract your current mortgage balance from your home’s estimated market value. For example, if your home is worth $400,000 and you owe $250,000, you have $150,000 in equity.

But here’s the key: most lenders will require you to leave at least 20% equity in the home after borrowing. That means you can’t pull out the full $150,000 — only a portion of it.

Let’s break that down:

- 20% of $400,000 = $80,000

- To leave that 20% in place, subtract that amount from your $150,000 equity

- $150,000 – $80,000 = $70,000 that you can potentially access (less closing costs)

This number could vary based on the lender, your credit, debt-to-income ratio, and which product you choose — but this gives you a general benchmark to work from.

2. Assess Your Finances

Take a close look at your monthly income, expenses, and any other debts. Make sure you know how much cash you need, how you’ll use it, and whether it makes sense to borrow a little extra for emergencies.

3. Choose Your Equity Product

Pick the tool that fits your financial goals. HELOCs offer flexibility, home equity loans provide a lump sum with predictable payments, and home equity investments offer cash with no monthly payment — in exchange for a share of future profits.

4. Apply with a Lender

Shop around and compare offers. Look at interest rates, fees, repayment terms, and how each product would affect your monthly cash flow.

Don’t be afraid to negotiate — especially on origination fees or closing costs.

Be prepared with documentation like income statements, tax returns, and asset details to streamline the process.

The Bottom Line

There’s more than one way to access your home equity — and refinancing isn’t your only option. From second mortgages like HELOCs and home equity loans to alternative tools like home equity investments and reverse mortgages, each product offers unique advantages depending on your age, equity position, financial goals, and risk tolerance.

If you want to keep your current mortgage, a HELOC or home equity loan might be a fit — assuming you’re comfortable with a second monthly payment. A home equity investment may work better if you want a lump sum without taking on debt or interest. And if you’re 62 or older, a reverse mortgage could offer income without monthly payments at all.

Of course, refinancing still has its place — especially if it helps you lock in a better rate, consolidate debt, or adjust your loan term.

Not sure which path is right for you? Talk to a mortgage professional. They can walk you through your options and help match you with the solution that makes the most sense for your situation.

More Reading

Want to read more about tapping into your home equity? Check out these recent articles.

Building Home Equity: The Five-Year Rule

Good and Bad Reasons for Tapping Home Equity

Using a Home Equity Loan to Help Sell a House

Home Equity Loan & HELOC Payment Calculator